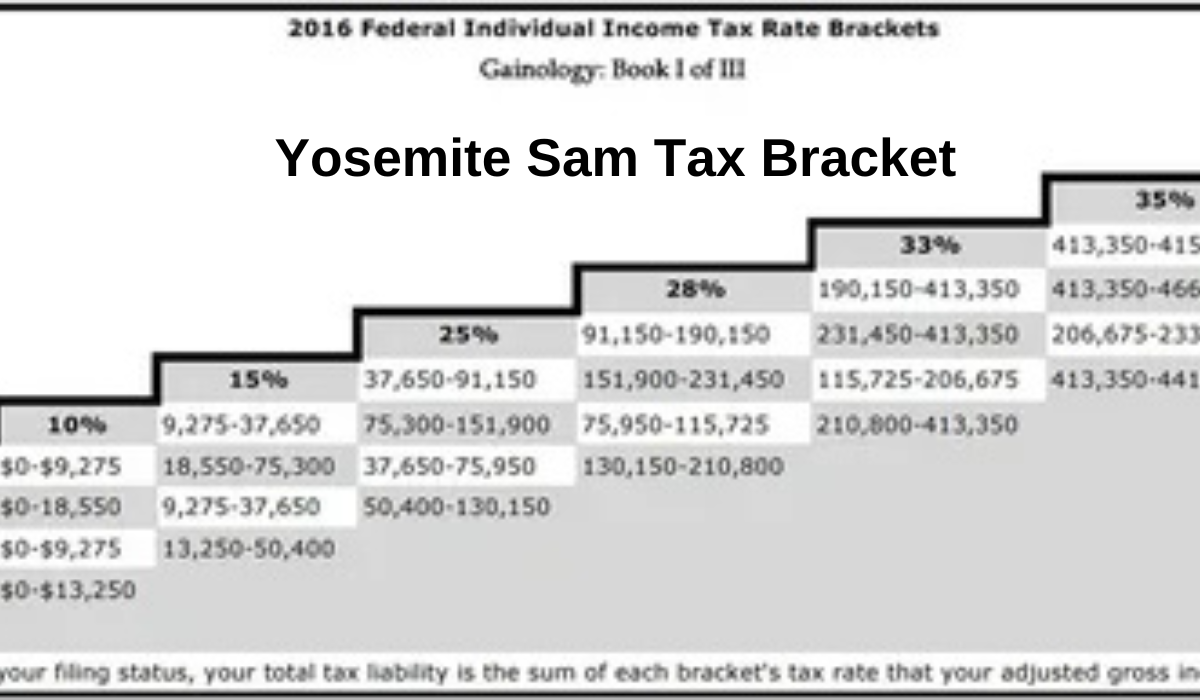

Introduction Yosemite Sam Tax Bracket

The IRS has just unveiled its updated federal income tax brackets for 2025, which will directly impact your tax returns filed in 2026. This announcement introduces several important changes, aimed at addressing inflation and ensuring that taxpayers experience some relief with the higher income thresholds for various tax brackets. Whether you’re an individual taxpayer, married couple, or head of household, understanding these adjustments will help you plan your finances more effectively. In this article, we’ll break down these changes and provide a comprehensive guide to ensure you’re fully informed about the IRS’s 2025 tax bracket adjustments.

Key Changes to the 2025 Tax Brackets

The IRS has raised the income thresholds for each tax bracket, meaning many individuals will be taxed at lower rates or can earn more before reaching a higher bracket. Here are the main updates you need to know about:

- Top Tax Bracket: The highest federal tax rate of 37% will apply to single filers earning more than $626,350 and married couples filing jointly earning over $751,600. This provides a substantial increase, offering relief to high-income earners.

- Other Key Brackets:

- 35% tax rate for incomes exceeding $250,525 ($501,050 for couples).

- 32% tax rate for incomes over $197,300 ($394,600 for couples).

- 24% tax rate for incomes over $103,350 ($206,700 for couples).

- 22% tax rate for incomes exceeding $48,475 ($96,950 for couples).

- 12% tax rate for incomes over $11,925 ($23,850 for couples).

- 10% tax rate for incomes at $11,925 or less ($23,850 or less for couples).

These tax brackets are adjusted for inflation, providing taxpayers with more room to earn without moving into a higher tax rate.

Standard Deduction Increases for 2025

For those claiming the standard deduction, there are significant increases to look forward to:

- Single taxpayers and married individuals filing separately will see an increase of $400, raising the standard deduction to $15,000.

- Married couples filing jointly will benefit from a larger increase, with the standard deduction rising by $800 to $30,000.

- Heads of households will see an increase of $600, with the new standard deduction amount reaching $22,500.

These increases are part of the IRS’s efforts to adjust for inflation and provide greater tax relief to individuals and families.

Other Notable IRS Updates for 2025

The IRS has made various adjustments across a range of tax provisions. Here are some of the most important changes:

- Earned Income Tax Credit (EITC): The maximum credit for those with three or more qualifying children will increase to $8,046, up from $7,830. This is particularly important for lower-income taxpayers, as it will help provide additional financial support.

- Transportation and Health Benefits:

- Monthly limits for qualified transportation fringe benefits and qualified parking will rise to $325, up from $315 in 2024.

- Contribution limits for health flexible spending accounts (FSAs) will increase to $3,300, up from $3,200 in 2024. Additionally, the carryover limit for unused FSA funds will increase to $660 from $640.

- Medical Savings Accounts:

- For individuals with self-only coverage, the deductible range will increase to $2,850 to $4,300.

- For family coverage, the deductible range will rise to $5,700 to $8,550, with the cap on out-of-pocket expenses increasing to $10,500.

- Foreign Earned Income Exclusion: The amount for foreign earned income exclusion will increase to $130,000, up from $126,500 in 2024. This is beneficial for U.S. citizens working abroad.

- Estate and Gift Taxes:

- The basic exclusion for estates will rise to $13,990,000.

- The annual gift exclusion will also increase to $19,000 in 2025, up from $18,000 in 2024.

- Adoption Credits: The credit for adoption expenses related to children with special needs will increase to $17,280, up from $16,810.

What Remains Unchanged?

Despite many increases, several tax rules will remain unchanged:

- Personal Exemptions: These will remain at zero, in line with the provisions established by the Tax Cuts and Jobs Act of 2017.

- Itemized Deductions: There will be no cap on itemized deductions in 2025, meaning taxpayers can fully deduct eligible expenses without limitations.

- Lifetime Learning Credits: The income threshold for this credit remains unchanged, with phase-outs beginning at $80,000 ($160,000 for joint filers). This figure has not been adjusted for inflation since 2020.

Special Focus: Yosemite Sam Tax Bracket – What It Means for High Earners

While the updates primarily benefit all taxpayers, it’s worth mentioning the Yosemite Sam Tax Bracket for high earners. This refers to the 37% tax bracket, which now applies to individuals earning over $626,350 and married couples earning over $751,600. The increase in the threshold for this top bracket provides notable relief for those who might otherwise be subject to higher taxation.

High earners will appreciate the adjustment, as it helps offset the effects of inflation and rising living costs. The Yosemite Sam Tax Bracket changes will allow these individuals to retain more of their income in 2025, providing valuable financial flexibility.

State-Specific Updates: California’s 2024 Tax Bracket Changes

In addition to the federal changes, many states, including California, have also adjusted their tax brackets for 2024. While these changes primarily affect state taxes, understanding them is crucial for taxpayers who live in states with high-income tax rates like California. The state’s adjustments reflect a 3.3% inflation rate and include increases in personal exemption credits, renter’s credits, and standard deductions.

Final Thoughts

The IRS’s 2025 tax bracket changes are aimed at providing significant relief to taxpayers, especially high earners, as the adjustments align with inflation. Whether you’re eligible for a higher standard deduction or fall into the newly adjusted tax brackets, understanding these changes is essential for making the most of your tax return. Be sure to stay updated on any additional state-specific changes and consult a tax professional to navigate the complexities of these tax updates.

By staying informed, you’ll ensure that your tax planning for 2025 is as effective and efficient as possible, leading to potential savings and a smoother tax season.

YOU MAY LIKE: This Blog Will Show You About the New Digital Technology in Thailand: A Glimpse into the Future of Innovation and Connectivity